My notes, observations & learnings from the Adtech Sydney Conference on 17th August.

The event was moderated by Joe Copley (Seedooh) who gave his take on the role and importance of AdTech to OOH’s future.

Key Note - MIQ – Jason Scott & Belinda Cooper – Big Picture Programmatic (Featuring DOOH).

Cookies are (almost) dead – Can DOOH take the biscuit.

MiQ is an independent omnichannel DSP who have stitched together a mixture of programmatic tech so that they can transact across multimedia using consistent data sets to make smarter decisions.

90% of the way they plan, and buy is getting ready for a cookieless future – within 12 months they will be at 100%.

Trends over time have showed more media spend is going to Digital media – and when you look at digital media spend more share is being spent programmatically.

Data also shows that in Australia that there is an appetite for increasing DOOH spend vs classic formats – this is a lot healthier in Australia then other global markets (probably due to the infrastructure).

Key message for the OOH sector is keep innovating your AdTech and it will benefit you in the long run.

Without cookies – things start to break – like audience targeting and retargeting, insights and optimization, frequency capping, measurement, and attribution.

MiQ’s 3 ways to overcome cookies….

What’s in it for DOOH companies?

Opportunity to increase price through CPM model.

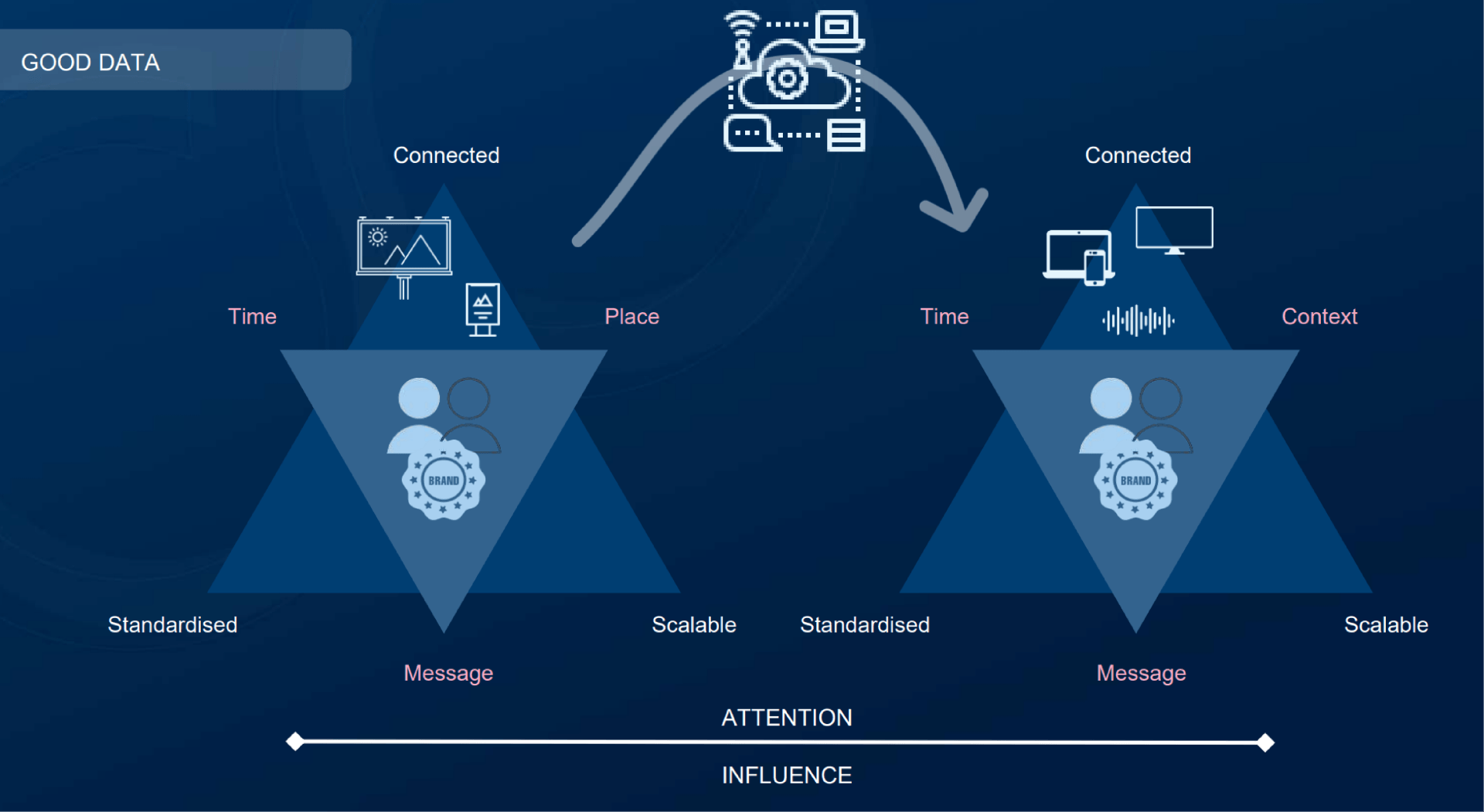

Opportunity to become a part of the screen strategy.

What are customers saying…

Measurement and attribution are going in the right direction for DOOH – keep investing in MOVE 2.0 as a common currency + other datasets that prove attribution & effectiveness etc.

Omnichannel exposure – OOH is showing positive results so far in terms of how it’s contribution to the omnichannel approach and total campaign results.

Creative service is currently an issue (e.g., too many creative sizes and time consuming to ad serve tricky campaigns etc.) – something the industry should learn from via what online media did & the IAB facilitated.

Panel 1) Max Eburne JCD; Emma Hegg oOh; Grant Guesdon (OMA & MOVE) & Luke Hutchinson (Hearts & Science & OFC...

From Battleground to solid ground. How, why and when?

Previous years lack of OOH alignment between buyside, sell side and tech companies – therefore AdTech couldn’t amplify the medium as they couldn’t agree on getting the foundations set.

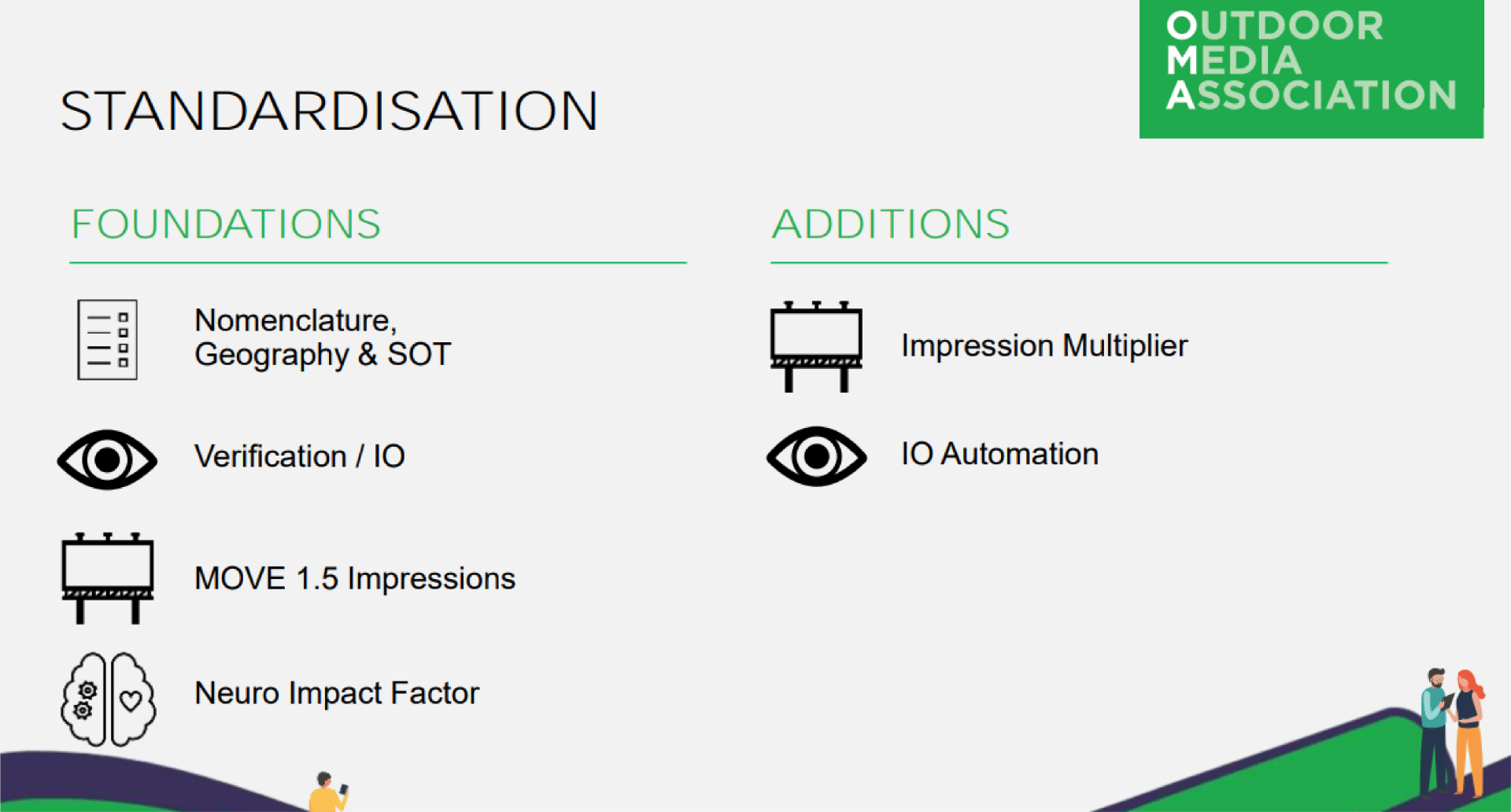

After a rocky start the OFC and OMA realised they were working to mutual goals etc. Therefore, projects like standardisation, MOVE 2.0 and the Impression multiplier started to take shape.

Standardisation includes:

Improvements have been:

- Common naming & geographies.

- MOVE 1.5 – Creating Share of Time as the currency so the DOOH measurement could move forward.

- Creating an industry IO form for all suppliers.

- Introduction of a Neuro Impact factor – that helps the buy side understand that not all impressions in OOH are the same.

Additions incoming are:

- Agreed standardisation of the impression multiplier using MOVE data + a solution to automate the IO process.

- What the OMA is planning a future around includes:

- Standardisation Roadmap – Programmatic, Education/Training, MOVE 2.0 Development, APIs to MOVE 2.0.

Attitudes to Programmatic DOOH – The agency Lowdown

- Gai Le Roy (IAB) & Ben Allman (Co Chair DOOH – IAB):

Attitudes to DOOH – IAB – survey results

Methodology (check photo) – standard survey - 530 buy side (380 agencies, 73 brands/advertisers, 77 AdTech)

Macros learning - More buyside still considering transacting via traditional methods than PDOOH at planning stage currently.

Driven by Planning and Investment teams who are the biggest KDM’s at agencies if they choose to use PDOOH.

Drivers of using PDOOH

Data and Targeting, flexible buying options, contextual relevance, operational efficiency the stand outs on why you would use PDOOH…

Objectives for using PDOOH

Increase brand no. 1 but DR has improved the most over last 12 months.

IAB made comment that DR needs more work as the industry needs to work together to agree on what metrics are right and standardised.

Buying methods used so far

Open Exchange number 1 (55%) vs PMP number 2 (45%) & guaranteed deals no.3 (34%)

IAB made comment that PMP is quite strong due to the two biggest OOH suppliers only offering PMP transactions.

Opportunities for growth….

Offering a guaranteed way of transacting – non-guaranteed only is turning off people as they know that traditional buyers get priority to the best assets.

Promoting further understanding = education/ training.

Panel 3 – Is it still 2020/ or 2024 already? Where are we really at with PDOOH in 2022? - James Bayes GM The Tradedesk

– David Sutherland QMS, Pia Coyle Avenue C and OFC, Clare Tsubono LION

Observations from this panel:

OOH industry really needs to understand how Video got it so right – Agencies always including BVOD as part of their screen strategy now. It’s now often sold out.

OOH industry has done well to unite and make sure Verification is accessible – client’s who spend loads of money like LION need verification – it’s 100% a part of their approach to OOH now.

Current issue with PDOOH is that they only have the option to execute non-guaranteed buying only. Can understand that traditional buyers as well would prefer to buy direct and guarantee their locations because they have come from a mindset that you are buying real estate – so you are buying site quality – not audience impressions.

There is also an obvious conflict occurring between sales teams at organisations – often traditional sellers tell the client – ‘if that’s what you want just book directly with me’… this makes it confusing about what are and what aren’t the benefits of PDOOH.

However currently there is more supply as more operators get involved, there is experiments occurring around things like header bidding and dynamic creative optimisation etc which will improve the experience.

In 12 months … (clare) verification adopted by all advertisers a must & to find a better use of my postcode 1st party data, (pia) a big case study that showcases the benefits of PDOOH, (Sutho) for more agencies to have understanding how best to execute e.g. can I just book straight with the supplier or do I need to involve omnichannel DSP’s (Yahoo, TheTradedesk etc) and pay an additional fee… (James) I’d like to see more local case studies – seeing some great stuff from OS.

There was a comment that PDOOH didn’t get off to a good start 4 years ago because it was being led by the AdTech companies…. It was obvious Supply side weren’t bought into the benefits of its introduction – Video got it right because it was led by the Supply side, and they were united in when to use it and how to use it.

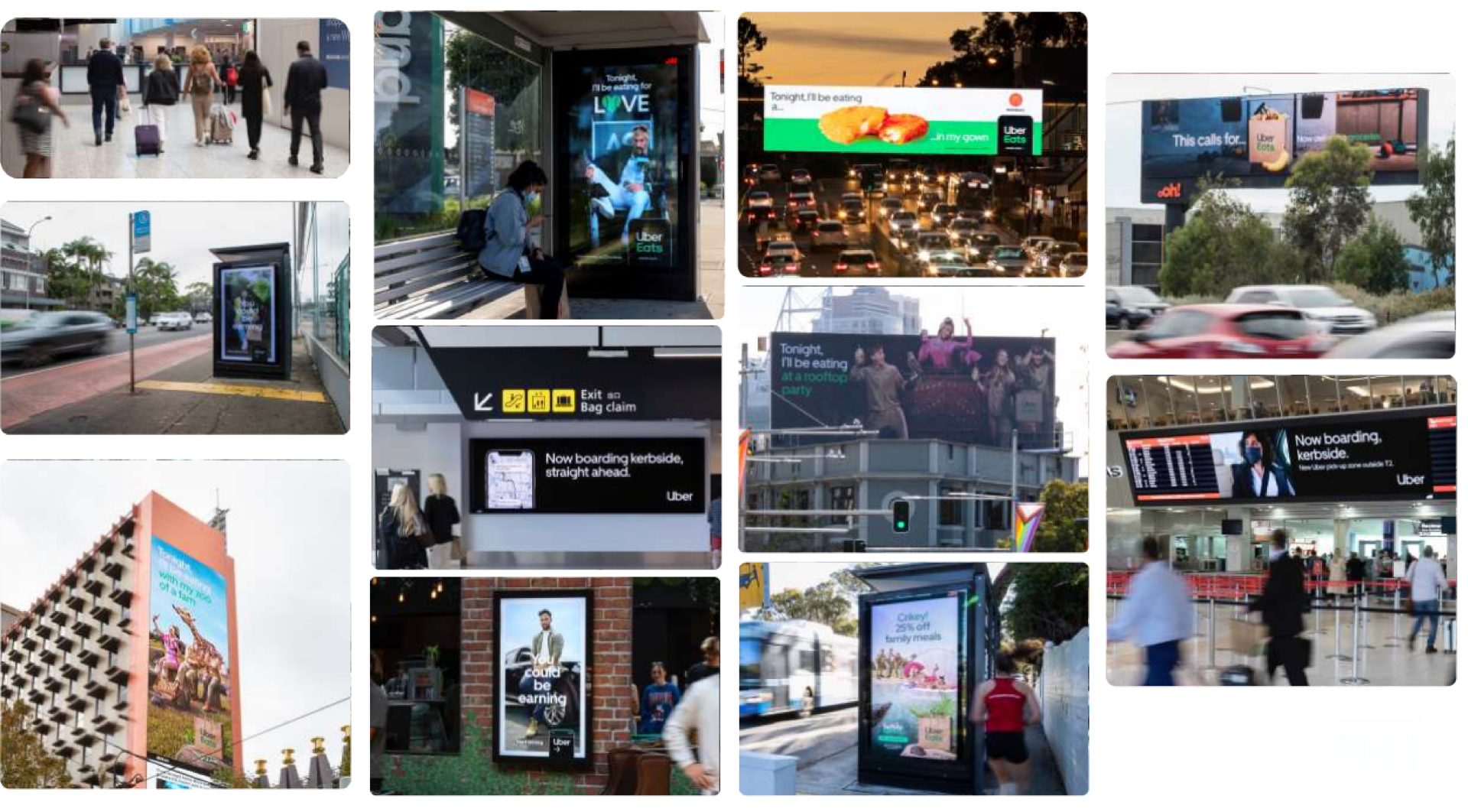

FIRESIDE CHAT (Creative)… Tonight Ill be moving Outdoors, How Uber Eats engages audiences with DOOH

- Neil Ackland (oOh & POLY) & Andy Morley (Uber & Uber Eats)

Learning from Uber are:

- Uber have future plan to spend as much budget on OOH then they do for Linear TV.

- They are sold on the power of OOH.

- Cross measurement didn’t help OOH initially as the methodology didn’t single out OOH providing strong effectiveness. It was only when they excluded OOH they noticed their total campaign performance dropped off massively. There tracking methodologies weren’t picking up the synergy effect & heavy lifting that OOH does for their total market mix approach.

- They are completely sold on the importance of creative to the performance of OOH – currently a lot of people are getting it wrong.

- Neil refers to Analytic Parnters study (MMM averages) when creative is allocated 41% importance to an OOH campaign ROI… 59% being the site selection and ability to reach the right audience. However, that same study says creative is 65% of a TV’s ROI and 70% of a digital campaign comes down to the creative – so this basically shows currently OOH creative is below par and there is so much room for improvement.

- The opportunity for OOH industry is to step up with education to the creative industry on how best to use all your formats – atm there is so much poor creative using OOH.

- Get ready for the Attention economy – because it is coming.

- Technology has such an important future role to improving the quality of OOH creative.

- The problem with PDOOH is that it comes across as super expensive and it is super resource heavy to execute dynamic creative to different locations etc to be contextually relevant.

Bringing the Billboard to life: The latest innovation in programmatic OOH…

- James Lambert (Sightline) & Matt Bushby (Hivestack)

Learning from Sightline are:

- OOH needs flexibility…

- Now the infrastructure allows technology to innovate the medium.

- Misperception about Quality…. Get rid of talk of remnant inventory, it’s not remnant like online media

- Audience Targeting …. People not screens… people power data is a great thing for OOH channels

- Attribution …. this helps us prove we are starting to solve business problems…

- Dynamic creative is super important to deliver personalisation on scale.

- Price is currently expensive but there are good reasons why it is that way and happy to justify to their customer – having flexibility and options to turn off campaigns is super important in their approach to trading.

- Advantages for media owners - new revenue, new budgets, access to clients who don’t normally use OOH.

- Clients ask how quickly you can go LIVE – the general answer is 3 to 5 days – creative approvals is the hardest however there is no reason it can’t be quicker like social media.

- Encourage you to speak to more and more digital people at agencies – see if you can get 5% of their budgets because they buy out of the same platform now.

LUMO – NZ – Future Proofing the DOOH ecosystem

- Jack Plowright – GM of Programmatic & Chloe Van Diepenbrugge (Snr Agency Account Manager)

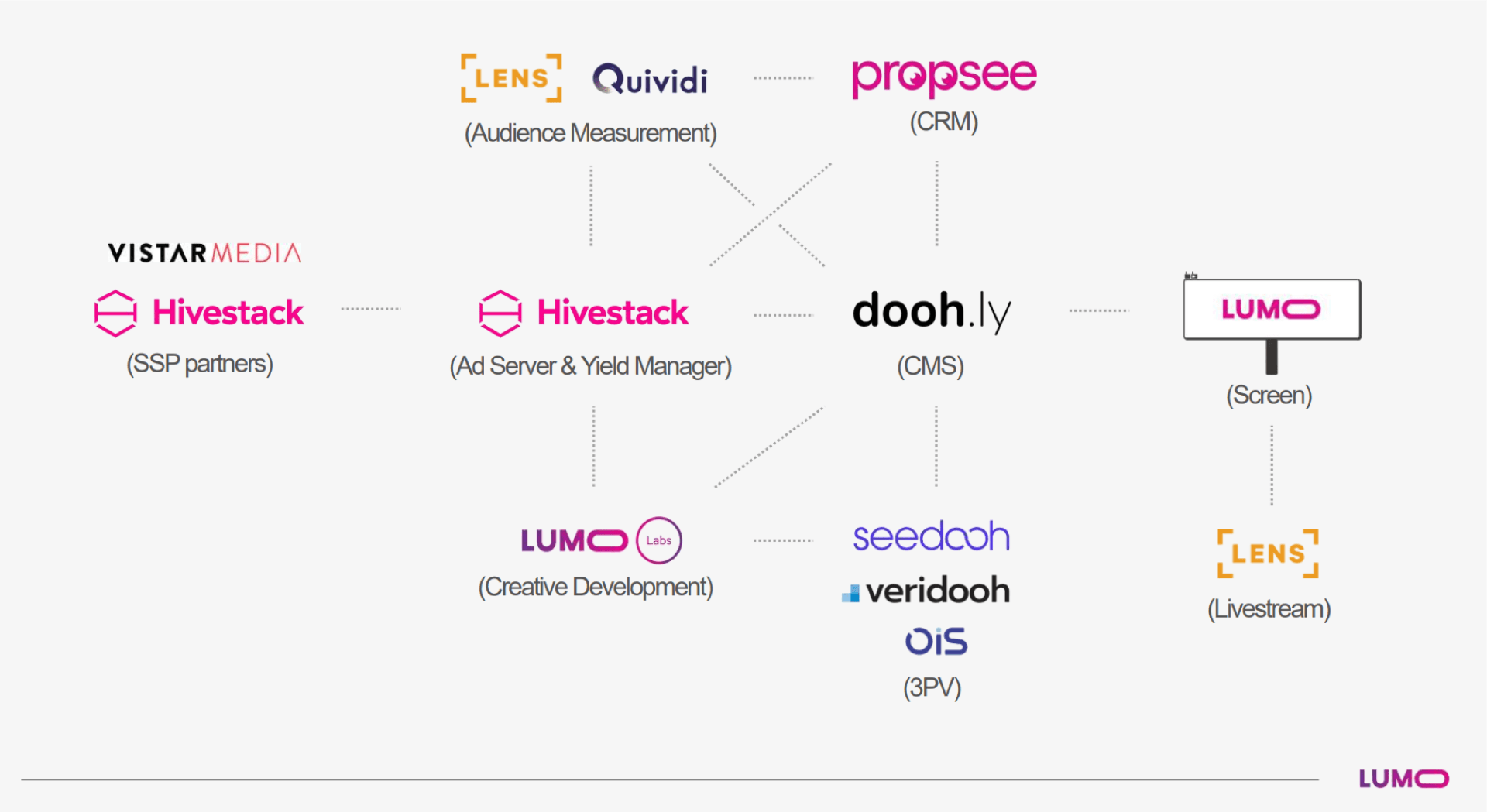

Demonstration on how they created all their AdTech partners to create their ecosystem and approach to PDOOH and data – they have preferred to do their own model rather than uniting with the NZ industry on things like audience measurement.

Reasons for that:

LIVE (data feeds so buyer is transacting the actual audience) TRANSPARENT (Using better data) & Properly connected (their platform approach)

Key learnings so far on their journey are:

- Standardise to satisfy, digitise to grow.

- Let API’s do they work (& automate the process)

- Lift the hood (transparency)

- Use AdTech to trim the fat (cut resource costs and become more profitable)

- Phase out the JPEG (for better creative quality)

- Test & Learn before you Earn